Showcasing the impact of PR work is notoriously difficult. We have teamed up with Steph Bridgeman, expert PR measurement consultant, to learn about how useful Google Trends can be when measuring the impact of your PR work.

Google Trends is a free tool that anyone can use. You can use it to discover how many people are searching for your brand over time, so it can be a great indicator that your campaign moved people to find out more.

In this article, Steph uses real-world examples to showcase how you can use it effectively in your PR reporting…

How to benchmark brand awareness using Google Trends

Car manufacturer Jaguar boldly launched a new brand identity and advertising campaign and this captured commentator and consumer attention globally. How do we know this? Marketers and PR professionals will no doubt have seen their social feeds flowing with reactions and opinions, be they good or bad. The story travelled beyond our industry bubble, landing high-profile mainstream coverage in the Daily Mail, BBC News, Sky News, Fox Business and beyond.

The activity has led to significant engagement – Jaguar’s own YouTube clip amassed nearly a million views and over 17k comments in just three days. Some media outlets have focused on the dip in Jaguar’s share price amid ‘backlash’ for the ‘woke’ campaign. Some have called this a Bud Light 2.0 moment for the automotive brand.

Through the lens of Google Trends, the increased awareness is clear. Here is a screenshot of people searching for the term ‘Jaguar’ worldwide over the past 90 days:

Looking back over a longer time frame (five years, screen shot below, global search), the recent spike in interest and search activity indicates that the story may turn out to have been one of the biggest catalysts for branded internet search for Jaguar over the past five years:

Google Trends offers the chance for marketing professionals and media analysts to explore what’s on people’s minds. If we have something on our mind and we want to seek out further information, inevitably we Google it.

Google Trends can also be an indicator of consumer consideration – the intent behind search terms – phrases such as ‘restaurants near me’ or ‘best luxury car brand’ – can be indicative of purchasing consideration.

Because Google Trends’ historic data goes all the way back to 2004, benchmarking is possible. The term ‘woke’ for example has mainly entered the mainstream consciousness in the past five years, as evidenced by the worldwide volume of search over 20 years:

Benchmarking is a useful way to demonstrate ‘so what’ – without an understanding of what ‘normal’ looked like before marketing or comms activity commenced, how is it possible to demonstrate impact?

Here’s another example. In February 2021 a campaign by breakfast cereal Weetabix, caused a stir on Twitter, as it was known then. Weetabix had posted a picture of its product topped with another British food staple: Heinz baked beans. The social media post caused an emotive response online, which prompted considerable earned media across national news outlets as well as the marketing trade media, ensuring that exposure to the social media activity stretched beyond the typical reach of a single social media post.

The phrase ‘Weetabix baked beans’ had hardly been searched before the campaign (why would you?). Google Trends clearly shows how that moment in time, February 2021, led to awareness and action (ie search). The chart below shows UK internet search since 2016 for the term ‘Weetabix baked beans’.

The team behind this campaign will likely have used these data streams to demonstrate the success of their activities:

- Social media reach and engagement (both owned and earned)

- Earned news coverage about the campaign, which helped to amplify reach of the original post

- Search data for a term which otherwise would have not had any search

Taking a screenshot of Google Autocomplete suggestions at the time of the campaign when most of the search activity is taking place can also prove insightful because the suggestions are powered by the underlying level of search for the associated terms. Even better, if you can remember to take a screenshot before comms activity takes place, the lack of campaign related search suggestions can also help to illustrate a ‘before and after’ viewpoint of the underlying level of search or awareness.

It is important to sign out of any Google accounts before taking the screen shot, and ideally to search via an incognito window to ensure that the results returned do not have the normal levels of personalisation that comes with being logged in.

In the Weetabix example, all of the Autocomplete suggestions below were linked in some way to the communications activity.

This approach also works for B2B brands and more niche terms. Because access to Google Trends is free and the time to gather the data is quick, organisations on limited budgets can get significant insight from the data returned.

Take the education sector; schools and colleges which receive government funding compete locally across a limited cohort of potential students for attention and enrolment. Search data can be the conversation catalyst that can open up budget conversations for more in-depth market research. Notably, search data provides an indication of ‘unprompted’ awareness.

Put yourself in the position of a marketing director for an educational establishment; you sense that competing local institutions are doing a better job in driving awareness and consideration for enrolment.

One quick-fire technique could involve typing in the name of your college and four local competing colleges into Google Trends, and exploring the relative levels of search over a given time frame. Assuming that all five institutions have a similar student size or potential local (and thus geographically limited) target audience, why do some institutions receive significantly more search than others? Is it indicative of the strength of their marketing and associated audience awareness?

Comparing your organisation’s performance in this way against your peers can lead to a metric called ‘share of search’. Share of search has been mooted by leading thinkers in both advertising and communications as a potentially better indicator of market share than ‘share of voice’ CoverageBook has been vocal on these metrics for some time, and you can hear more about this topic here and here.

How to visualise and graph Google Trends data with your coverage data

So now you understand the potential. How do you actually use it?!

Watch how on YouTube…

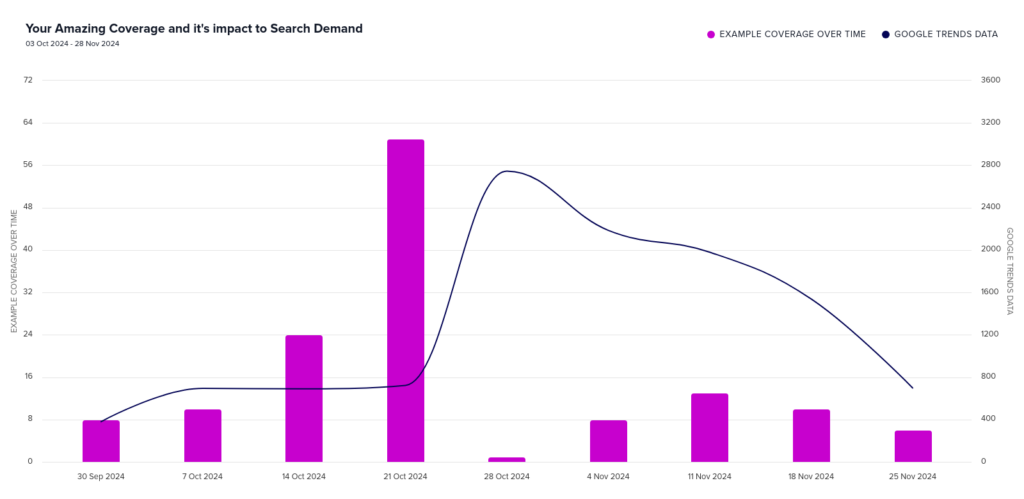

Correlate your PR activity & coverage with Google Trends data

Step 1.

Go to Google Trends

Look up the brand name or whatever you want to measure the awareness of, in this example that’s ‘Jaguar’

You can filter to data from a specific country.

Then look up data from a date range that will give you a good view of pre and post your PR activity.

Step 2.

Export the Google Trends data into CSV format. You may have spotted three icons to the right of the screen when exploring Google Trends:

The first icon allows you to download the trend data over time to a CSV file.

Step 3.

Go to the free tool CoverageImpact.

Firstly grab a list of all the dates that you got coverage and put into Google Sheets or Excel (we have a template here).

If you’re a CoverageBook user you can export your coverage data in a CSV and upload directly into CoverageImpact. The tool is also built to handle coverage data from lots of other popular PR tools too.

This will then create a coverage timeline of all your coverage. Which is a nice thing to have anyway.

Step 4.

Upload the Google Trends data you exported earlier.

Once you have a graph of your coverage timeline you’ll now be able to add “impact data”. In this case you can add the CSV of Google trends data….

You’ll then end up with your coverage data combined with Google Trends data. Pretty cool.